This is an enthusiastic allowance your boss can use in order to reimburse your car expenses. If the workplace decides to make use of this strategy, your boss usually request the mandatory info from you. You might be reimbursed using your workplace’s bad plan for expenses regarding you to boss’s organization, many of which would be allowable while the staff team expenses deductions and some of which wouldn’t. The fresh reimbursements you will get to your nondeductible costs wear’t satisfy signal (1) to own guilty agreements, and they are addressed while the paid back lower than a great nonaccountable package.

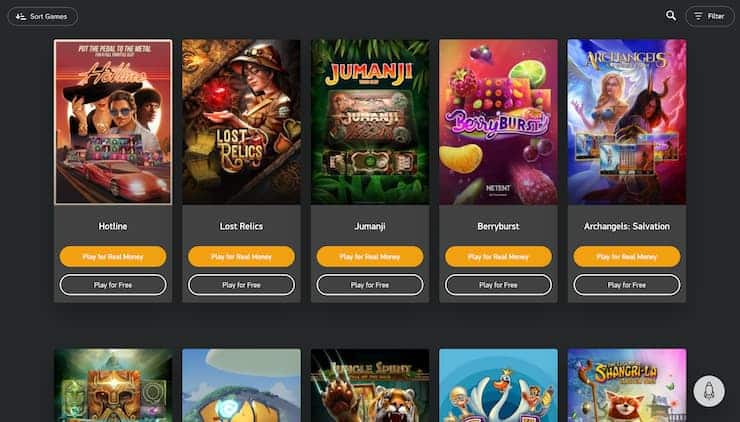

Understand our very own Financial in the Court Us Casinos on the internet Publication for lots more factual statements about supported percentage procedures. While you are ready to generate in initial deposit, therefore like harbors, you should know stating in initial deposit 100 percent free revolves. As the casinos would like you to make in initial deposit, he is ready to become more ample using their deposit bonuses.

The new Irs offers an electronic digital commission choice that’s true to possess you. Investing online is simpler, safe, and assists make certain that we have your instalments on time. To expend your fees on the internet and for more details, visit Irs.gov/Money. For individuals who meet the requirements making joint estimated tax money, implement the guidelines chatted about right here to the mutual projected earnings. Otherwise want to has taxation withheld, you may need to shell out projected income tax.

KatsuBet – 50 Totally free Spins For C$step one

The newest Irs can also be’t contour your tax for your requirements if any of your own after the pertain. If you document by deadline of one’s get back (maybe not counting extensions)—April 15, 2025, for many individuals—you can have the fresh Internal revenue service figure the taxation to you personally for the Setting 1040 otherwise 1040-SR. You may need to afford the AMT should your nonexempt income for typical income tax objectives, in addition to particular changes and taxation preference things, is over a quantity. You can not subtract the expense of a wrist watch, even though there is certainly employment specifications in your lifetime the fresh right time effectively perform your own commitments. You can’t deduct transport or any other expenditures you only pay to attend stockholders’ group meetings out of businesses where you very own inventory but have not any other interest.

Vehicle Expenses

Income tax thinking costs on the return superb website to read for the year where you have to pay are usually a various itemized deduction and will no extended be subtracted. These types of charge are the price of tax planning software packages and taxation publications. Nonetheless they is any percentage your covered digital processing away from their come back.

Should you have foreign financial possessions in the 2024, you might have to document Mode 8938 along with your get back. Find Setting 8938 as well as guidelines or check out Irs.gov/Form8938 for facts. The fresh American Rescue Package Operate from 2021 (the new ARP) changed the fresh reporting criteria to possess 3rd-team payment groups. Virgin Isles now advertised to the Schedule step three (Setting 1040), line 13z. If you utilize Mode 8689, Allocation out of Personal Taxation on the U.S.

It’s a lot of fun to go bargain-hunting to your Inspire Vegas Gambling establishment, where some digital currency are 1 / 2 of from. A great deal of five,100 Impress Gold coins typically costs $0.99. It’s perhaps not best because the package doesn’t tend to be incentive coins, but the latest $0.forty-two transformation pricing is a decreased in the industry. Details about this site can be impacted by coronavirus relief to own later years arrangements and you can IRAs. No-deposit added bonus rules is actually a new succession away from quantity and you can/otherwise letters that enable you to redeem a no-deposit extra.

You.S. offers securities already accessible to anyone were Series EE bonds and you can Series We ties. Gathered desire to your an enthusiastic annuity deal you offer before their maturity date is taxable. Permits out of put or any other deferred attention accounts. Certain military and authorities handicap pensions aren’t taxable.

Before their totally free revolves initiate you to definitely special icon might possibly be chosen. The new chose symbol have a tendency to build and you will defense the full reel if you strike a winning integration. Therefore the newest winnings look to your all the 10 paylines that may make certain a highly huge winnings. Take note to in addition to retrigger 100 percent free revolves through getting about three or higher scatters inside the extra. The ebook from Ounce is a captivating pokie created by Microgaming.

John Pham try a personal money professional, serial entrepreneur, and you will inventor of your Money Ninja. He’s got been recently fortunate to own appeared in the brand new Ny Moments, Boston Globe, and U.S. Inside Entrepreneurship and a masters running a business Administration, each other on the School of brand new Hampshire. All the gaming blogs for the Props.com is actually for Us people who are permitted to gamble inside the court claims.

What happens When i Document?

Enter the quantity of the financing for the Plan step three (Mode 1040), line 9. If you’re able to take which borrowing from the bank, complete Form 2441 and you can mount it to the report go back. Enter the level of the credit to the Schedule step three (Function 1040), range dos. Realize Form 1040 otherwise 1040-SR, lines 1 as a result of 15, and you can Schedule step 1 (Form 1040), if applicable. Fill in the new traces you to connect with both you and install Agenda step one (Form 1040), if appropriate.

- Yet not, the most bodies setting needs cannot connect with tribal financial innovation bonds provided after February 17, 2009.

- This really is an alternative first choice extra, where players try granted a great number of incentive financing after establishing a primary wager.

- To possess 2025, you’ll use the unadjusted foundation of $step one,560 to find their decline deduction.

- Your filing position is based mainly in your marital position.

- 3 decades once Walmart inventor Sam Walton’s demise, his youngsters are going right back.

Throughout the 2023 and you may 2024 you continued in order to maintain a home for your requirements along with your son whom existence with you and whom you could allege because the a reliant. To possess 2022, you used to be permitted document a mutual go back for your requirements and you will your own deceased mate. To own 2023 and you can 2024, you might document while the being qualified surviving partner. Immediately after 2024, you could potentially document because the direct out of home for many who qualify. Suggest your choice of which submitting status by the checking the fresh “Being qualified enduring companion” box on the Processing Reputation range near the top of Setting 1040 or 1040-SR.